|

|

|

|

|

|

|

|

|

| Home | Updates | History | Blogs | Portfolio | FAQ | Contact | Terms Of Use |

|

|

|

|

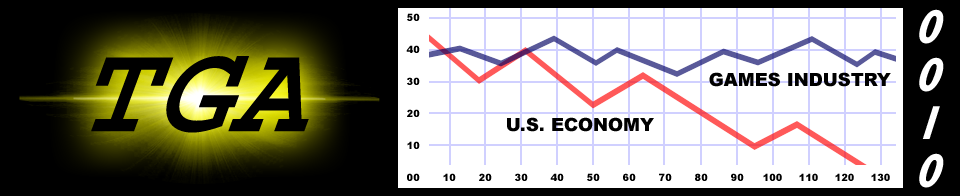

The games industry does, indeed, appear to be enjoying historically good sales of its products, during the holiday season, and during an incredible economic downturn that is negatively affecting the bottom line of most other industries. Industry analysts, game publishers, game developers, and stock market investors are marveling at this inexplicable event, being guardedly optimistic, thanking God, and scrambling to buy in with any remaining liquidity, respectively, all at once.

If you allow yourself, for a brief moment, to look at the underbelly of the bottom line, you will discover, however, that there is an equally good deal of restructuring and workforce dumping that is occurring in the games industry, all to remain in-the-black for some and a little less in-the-red for others.

The games industry, over the past 2-3 decades, has been growing more and more cyclical in its preparation for new console, handheld, and mobile phone game hardware platforms (e.g. Sony Playstation 4). There is a noticeable difference this time around, as there are, roundly, no new evolutionary hardware platforms (with wildly unique specs) due out anytime soon.

And the PC games market continues to search for its identity ("Am I shrinking, am I stagnant, or am I making a comeback?) in the face of acknowledged market share losses to console and handheld products, even with the inevitable wave of new, reasonably-priced 1GB video cards that seriously encourage the creation of more intense, higher speed, higher detail, higher bandwidth, ultra-complex games (which, besides casual games, are viewed as the tentative savior of the PC games market).

This now-traditional "retooling" cycle, specific to the arrival of new hardware, will be business as usual, objectively speaking, until consumers, particularly here in the U.S., are left with no choice but to convert their monies of discretion into monies of necessity. Does a blu-ray disc-based video game taste good with salt and pepper? Somebody who prefers escapism over all else (including potential home foreclosure) is bound to find out soon enough.

The other, long-term, sales-altering concept to keep in mind is one of diminished talent pools. The more this retooling cycle occurs, the more potential new workers are added into the industry, with less and less appropriate training towards the creation and manufacture of specialty products, like video games.

Time is money, thus, fewer and fewer publishers and developers are willing or interested in training this new, lower-cost-but-higher-risk work force. This new work force will either be lucky enough to receive some form of game development education through technical schools, or they will be self-trained through "MODs" of existing popular game products. This may steadily translate into less and less SOP (standard operating procedure) by this new workforce, less and less willingness to follow SOP by this new workforce, and less and less quality product delivered by this new workforce because of deteriorating production infrastructure.

In an industry where the quality bar is reset once or twice per year, objectively, the above concept will stunt such growth in quality and growth in sales to consumers who may, someday, insist on nothing but quality. The American automotive industry, after all, is neither the first nor the last business sector that will have its product line smashed by the hammer-of-public-opinion (regardless of whether a product is as tangible as a mode of transportation or as discretionary as a video game).

Some possible solutions to this potential problem are detailed in a recently-posted multi-part article of mine entitled "Transforming the Games Industry into a Well-Oiled Machine."

Games Industry stocks, it is worth noting, are also cyclical, annually going through the highs of potentially great sales and the lows of unpredictable production periods. Sumner Redstone will tell you that buying into entertainment software development is not a sprint but a marathon, and one which, after months and years in length, might not always end well. Nonetheless, keeping a forward-thinking eye on-and-under the bottom line will help prevent it from getting close to the bottom of the barrel, no matter the industry. |